Consolidated Uranium Acquires Three Additional Uranium, Vanadium and Rare Earth Projects in Queensland, Australia

Toronto, ON, September 6, 2022 – Consolidated Uranium Inc. (“CUR”, the “Company”, “Consolidated Uranium”) (TSXV: CUR) (OTCQB: CURUF), is pleased to announce that it has entered into a definitive share sale and purchase agreement (the “Agreement”) dated September 5, 2022 with GlobalOreInvestments Pty Limited (“GOI”) pursuant to whereby CUR has agreed to acquire (the “Acquisition”) of from GOI all of the outstanding shares of Management X Pty Ltd. (“Management X”), a privately owned Australian exploration company which holds a 100% undivided interest in the West Newcastle Range, Teddy Mountain and Ardmore East Projects (the “Projects”).

Highlights:

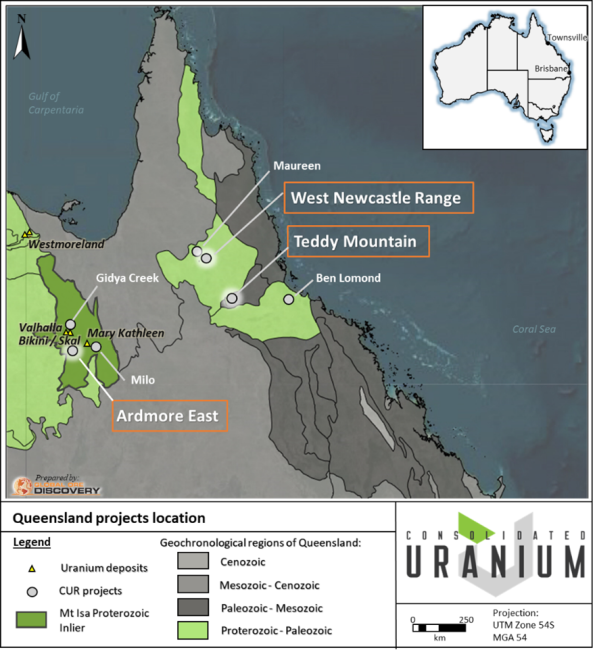

• Significantly expands CUR’s footprint in Queensland with all three Projects located in proximity to CUR’s existing portfolio of owned and optioned assets, including the Ben Lomond, Georgetown, Milo and Gidyea Creek projects (Figure 1).

• Known uranium prospects and untested exploration upside across all three Projects.

• Both West Newcastle Range and Teddy Mountain have potential for the discovery of high grade, near surface Uranium mineralization with historic results including:

o 12 metres grading 0.57% U3O8 from 23 metres and 10 metres grading 0.59% U3O8 from 42 metres at West Newcastle Range

o 10 m at 0.63% U3O8 including 2 m @ 1.8% U3O8 from 12 m at Teddy Mountain.

• Ardmore East covers exploration stage prospects with uranium and vanadium mineralization, and anomalous REE signature.

Philip Williams, CEO commented, “Expanding our project portfolio in Australia has been a key goal for the Company with this latest acquisition establishing a critical mass of seven projects in Queensland, in two important uranium districts, all in close proximity to one another. Not only do these Projects have compelling historic uranium drill results, they boast exploration potential and show evidence of vanadium and rare earth mineralization, which is becoming increasingly strategic in Australia, as well as globally, and could play an important role in our future development plans in the state. While our near-term focus remains on advancing our past producing uranium mines in the US toward a potential production decision, our longer-term goal is to build out our development pipeline through either additional M&A or by advancing existing projects within our portfolio. To this end, our team in Australia is developing a comprehensive exploration plan for these projects which we will update the market on in due course.”

Figure 1: Location of CUR’s current Projects in Queensland, Australia

Terms of the Sale and Purchase Agreement

Pursuant to the Agreement, CUR will acquire 100% interest in the Projects for the following consideration:

• $200,000 in cash upon granting of the West Newcastle Range, Teddy Mountain and Ardmore East exploration licences; and

• 598,843 common shares in the capital of the Company (“CUR Shares”) at a deemed price per share of $2.296. In addition, CUR has agreed to make two separate contingent payments of $500,000, payable in cash or Common Shares at CUR’s election, should either of the following milestones being met within eight years:

• the month-end Ux U3O8 price as published by UxC, LLC exceeds US$60/pound; and

• a National Instrument 43-101 compliant mineral resources estimate for the West Newcastle Range and Teddy Mountain projects is prepared where the mineral resource estimate is greater than or equal to 6.0 Mlbs of U3O8, or with respect to the Ardmore East project the mineral resources estimate is greater than or equal to 3.0 Mlbs of U3O8 equivalent (U3O8 + V2O5 + REE-Y + P2O5).

Any Common Shares issued in connection with the Acquisition are subject to approval of the TSX Venture Exchange (the “TSXV”) and will be subject to a hold period expiring four months and one day from the date of issuance.

The West Newcastle Range Uranium Project

The West Newcastle Range project is an advanced stage exploration project located five kilometres northeast of Georgetown and approximately 40 kilometres southeast of the Georgetown uranium project. The West Newcastle Range exploration licence application consists of 78 sub-blocks covering a total area of 25,500 hectares (255 km2). Extensive uranium exploration has been carried out between 1973 and 1983, including airborne and ground based radiometrics, VLF-EM, rockchip and stream geochemical sampling, geological mapping and over 36,000 metres drilled over various uranium prospects. In today’s dollar terms, this level of inground exploration is estimated to cost in excess of CAD$20 million.

The West Newcastle Range Project comprises five main uranium prospects. The Two Gee, Gecko, Trident, and Sybnac Prospects form an approximately 5 km long structurally controlled trend on the northeast edge of an interpreted caldera margin. The Quartz Blow prospect is part of an additional 5 km long northeast oriented trend. Multiple other prospects occur on the project, with uranium intersected in drilling and encountered in surface samples.

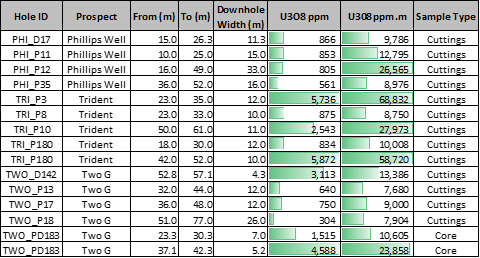

Significant historic drill intersections are shown in Table 1 below, including 12.0 m @ 5,736 ppm U3O8 from 23.0 m and 10.0 m @ 5,872 ppm U3O8 from 42.0 m Trident, and 5.2 m @ 4,588 ppm U3O8 from 37.1 m.

Table 1: West Newcastle Range drill composites with >7500 U3O8 ppm x meters calculated at a 150 ppm U3O8 cut off and a maximum of 2 m waste for Phillips Well (total 32 drillholes), Trident (total 49 drillholes), Two G (total 133 drillholes).

Untested outcropping mineralization is evident in the historic geophysical and geochemical datasets and the caldera volcano-sedimentary infill sequence is expected to be a prime target for large-scale, high-grade concealed mineralization as observed elsewhere in the world. World-class examples of caldera related volcanic Uranium deposits include the Streltsovsk district in Russia comprising >600 Mlbs U3O81 and the Dornod district in Mongolia >100 Mlbs U3O82. Other examples include the Xiangshan district (China), the Macusani district (Peru), the Kurišková and Novoveská Huta deposits (Slovakia) and the deposits of the McDermitt caldera (USA). Often the high-grade uranium mineralization within caldera systems is concealed and manifests a lower grade structurally hosted mineralization at surface.

Teddy Mountain Project

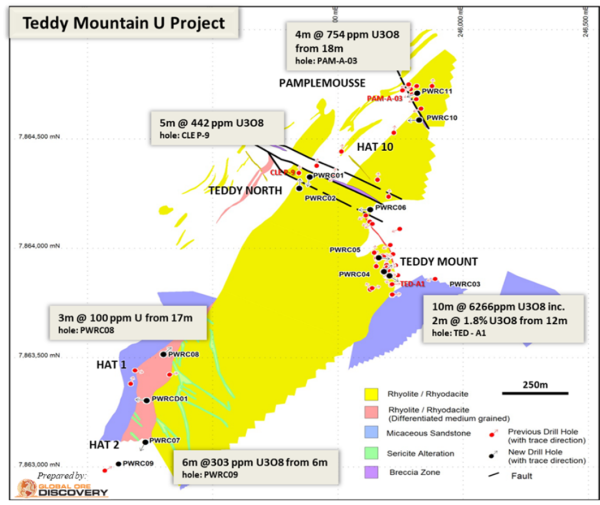

The Teddy Mountain Project is located approximately 230 kilometres west of Townsville and 180 kilometres west of the Ben Lomond Uranium-Molybdenum project (Figure 1) that contains historic mineral resources. Teddy Mountain comprises 100 sub-blocks covering a total area of 32,500 hectares (325 km2). Precious metal, base metal and uranium exploration activities were carried out from 1969 to 1983 and from 2008 to 2017. The Teddy Mountain Project is underexplored for uranium with exploration to date limited to 30 shallow drill holes totaling approximately 3,000 metres drilled mostly during the late 1970’s early 1980’s with 12 holes in 2009. Many historic drill holes failed to reach target depths due to drilling issues, and both the surface defined, and drill-intercepted mineralization remains open (Figure 2).

Selected drilling intercepts calculated using a 300 ppm U3O8 cut off and 1 m maximum internal dilution include:

• TED-A1: 10.0 m @ 6,266 ppm U3O8 inc. 2.0 m @ 1.8% U3O8 from 12.0 m

• CLEP-9: 5.0 m @ 442 ppm U3O8 from 43.0 m

• PWRC09: 13.0 m @ 187 ppm U3O8nc. 6.0 m @303 ppm U3O8 from 6.0 m

The highest priority uranium prospects are the Teddy Group, comprising Pamplemousse, Hat 10, Teddy North, Teddy Mount, Hat 1&2 prospects and the Big Hoy North & South prospects. All six prospects of the Teddy Group are aligned along a northeast trending structural corridor splaying off the east-northeast trending Teddy Mount Fault a major crustal scale structure. Initial exploration in the late 1970’s by Minatome following up airborne gamma radiometric anomalies defined a 171 m dozer cut bench with visible uranium mineralization with fourteen rock chip grab samples were collected, assaying up to 1.1% U3O8. Two historical specimen samples from surface mineralization at the Teddy North prospect of nodules of boltwoodite contained 45.4% U3O8 and 79.0% U3O8 respectively.

Untested outcropping mineralization is evident in the historic geophysical and geochemical datasets, drilling has not closed off mineralization at depth. Modern systematic exploration has been limited to known zones of mineralization. Mineralization is focussed along structure and at the base of impermeable cap rocks and conceptual potential exists for further high-grade mineralization to be discovered at depth.

Figure 2: Teddy Mountain Uranium Project historical drill results Minatome, 1977 and Rockland Resources, 2018

The Ardmore East Uranium-Vanadium Project

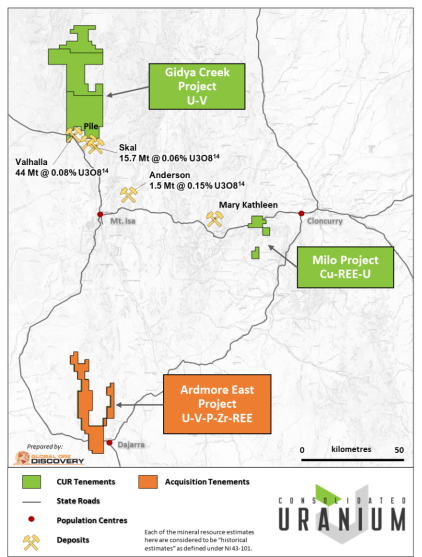

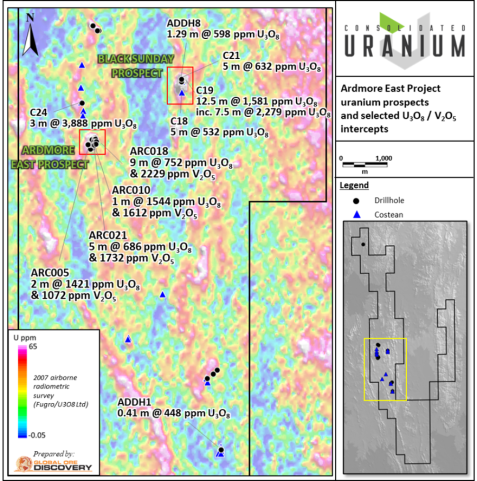

The Ardmore East project is located approximately 70 kilometres south of Mt Isa and 1 kilometre west of Dajarra in the state of Queensland, Australia (Figure 3). The tenement comprises 100 sub-blocks covering an area of 319.4 km2 (31,940 ha). Exploration of the Ardmore district began in 1952 with various explorers looking for Cu-Pb-Zn mineralization in Mt Isa Group equivalents, as well as uranium in the Eastern Creek Volcanics. To date, the Ardmore East project comprises, two uranium prospects (Ardmore East and Black Sunday) and several copper occurrences scattered throughout the property.

Figure 3: Location of Ardmore East Project

A total of 33 historical drill holes for 2,392.5 metres targeting down-dip extensions of surface uranium anomalies (from airborne radiometric surveys or bulldozer costeans) were drilled within the current tenement outlines. Assay results from the 2010-2011 drilling programs on the Ardmore East prospect revealed a zone of strong U3O8/V2O5 enrichment (up to 1,627 ppm U3O8 and up to 2,229 ppm V2O5; Figure 4) with strongly anomalous REE, Phosphate and Zirconium, over a 300 m strike length which remains open. A substantial part of the mineralization is associated with an albite-calcite-hematite-magnetite-apatite alteration assemblage which appears to be structurally controlled. Costean 24, located approximately 800 m northwest of the Ardmore East prospect (Figure 4), has the highest individual grade to date on the tenement with 0.5 metres @ 8,600 ppm U3O8 (length weighted average of 3.0 m @ 3,888 ppm U3O8) indicating a potential undertested extension of the Ardmore East Prospect. Uranium mineralization encountered at the Black Sunday prospect is located at the upper contact between altered basic tuffs and sediments of the underlying Mount Guide quartzite unit. Brannerite was identified as the primary uranium mineralization, while secondary uranium minerals consist of carnotite, tyuyamunite and meta-autunite. Uranium mineralization is associated with albitization, hematite dusting, jasper and titanomagnetite within meta-basalt and amphibolite host rocks.

Figure 4:. Selected Historic drilling results at Ardmore East Project

The uranium mineral systems observed at Ardmore East Project are comparable to Paladin Energy Limited’s (ASX:PDN) Valhalla deposit, that occurs ~100 km to the north. As with Ardmore, Valhalla is hosted sediment and tuff units within the Eastern Creek Volcanics on the western side of the Mt Isa Inlier. The Ardmore East Project covers over 250 sq kms of prospective Eastern Creek Volcanics with multiple other untested uranium radiometric anomalies with potential to host significant U/V mineralisation.

Corporate Update

CUR is also pleased to announce that it has engaged Momentum IR Corp. (“Momentum”), a Toronto based investor relations and corporate communications firm, to provide investor relations and advisory services. The initial term of the engagement is for 12 months with a monthly retainer of $8,000 per month. CUR has also granted Momentum 100,000 stock options pursuant to CUR’s long-term omnibus incentive plan. Each option entitles Momentum to acquire one CUR common share at an exercise price of $2.34 for a period of five years. To the knowledge of the Company, Momentum and/or its affiliates currently hold 1,500 Common Shares; however, Momentum may from time to time acquire or dispose of securities of the Company through the market, privately or otherwise, as circumstances or market conditions warrant. Momentum is at arm’s length to CUR and has no other relationship with CUR, except pursuant to the engagement. The agreement and the grant of the stock options is subject to the approval of the Toronto Venture Exchange.

References

1. Tarkhanov, A.V. and Bugrieva, E.P., (2012). World’s largest uranium deposits, Mineral’noe syr’e (Mineral Raw Material), Moscow: VIMS, 2012, no. 27.

2. International Atomic Energy Agency (2018). Geological Classification of Uranium Deposits and Description of Selected Samples. IAEA-TECDOC-1842.

Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Peter Mullens, the Vice President, Corporate Development of CUR, who is a “Qualified Person” (as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects).

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB: CURUF) was created in early 2020 to capitalize on an anticipated uranium market resurgence using the proven model of diversified project consolidation. To date, the Company has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina, and the United States each with significant past expenditures and attractive characteristics for development. Most recently, the Company completed a transformational strategic acquisition and alliance with Energy Fuels Inc., a leading U.S.-based uranium mining company, and acquired a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah and Colorado. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning CUR as a near-term uranium producer.

For More Information, Please Contact:

Philip Williams

Chairman & CEO

pwilliams@consolidateduranium.com

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future including, but not limited to, completion of the Acquisition and the Company’s ongoing business plan, exploration and work programs. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to Consolidated Uranium set out in CUR’s annual information form in respect of the year ended December 31, 2020 filed with the Canadian securities regulators and available under CUR’s profile on SEDAR at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable laws.