Consolidated Uranium Announces Mineral Resource Estimate for the Tony M Mine

Toronto, ON, December 13, 2022 - Consolidated Uranium, Inc. (TSXV:CUR) (OTCQB: CURUF) (“CUR”, “Consolidated Uranium”, the “Company”) is pleased to announce the completion of a confirmation drill program and a mineral resource estimate and supporting technical report prepared in accordance with NI 43-101 at the Company’s 100%-owned Tony M mine (the “Technical Report”). The Technical Report was prepared by the independent consulting firm SLR International Corporation (“SLR”) and has been filed under the Company’s profile on SEDAR.

Highlights

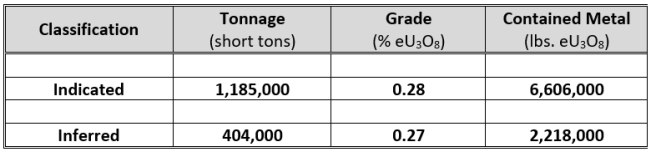

- The Mineral Resource estimate is based upon a commodity price of US$65.00 per pound of U3O8, and a cut-off grade of 0.14% eU3O8 are reported as an:

- Indicated Mineral Resource of 1,185,000 tons grading 0.28% eU3O8 for 6.6 million pounds contained uranium; and

- Inferred Mineral Resource of 404,000 tons grading 0.27% eU3O8 for 2.2 million pounds contained uranium.

- The Mineral Resource estimate for the Tony M Mine is consistent with the historic Mineral Resource estimate previously reported by Energy Fuels Inc. in 2012 when compared using a cut off grade of 0.10 % U3O8

- Key recommendations from the Technical Report include:

- Exploration drilling and underground sampling to investigate the vanadium potential of the deposit based on results from the confirmation drill program which showed the V2O5/U3O8 ratio ranges from an average of 1:1 to greater than 17:1 in places.

- Completion of a Preliminary Economic Assessment (“PEA”) to consider re-opening the Tony M mine (including Mineral Resource update)

Table 1: Summary of Mineral Resources – Effective Date September 9, 2022

Notes:

1. CIM (2014) definitions followed for all mineral resource classifications.

2. Mineral resources were estimated at a cut-off grade of 0.14% eU3O8.

3. Cut-off grade calculated using a US$65/pound uranium price.

4. Past Production (1979-2008) removed from the Mineral Resource.

5. Estimated mill recovery 96%

6. Totals may not add due to rounding.

7. Mineral Resources are 100 % attributable to Consolidated Uranium Inc.

Mineral Resources are not Mineral Reserves, and do not have demonstrated economic viability. While the estimate of Mineral Resources for the Tony M Mine is based on the SLR Qualified Person’s judgment that there are reasonable prospects for eventual economic extraction, no assurance can be given that Mineral Resources will eventually convert to Mineral Reserves. As of the date hereof, there are no other known environmental, permitting, legal, social, or other factors that would affect the development of the Mineral Resources.

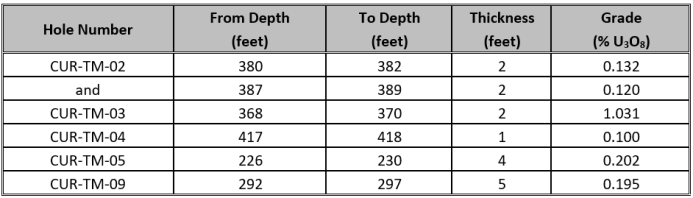

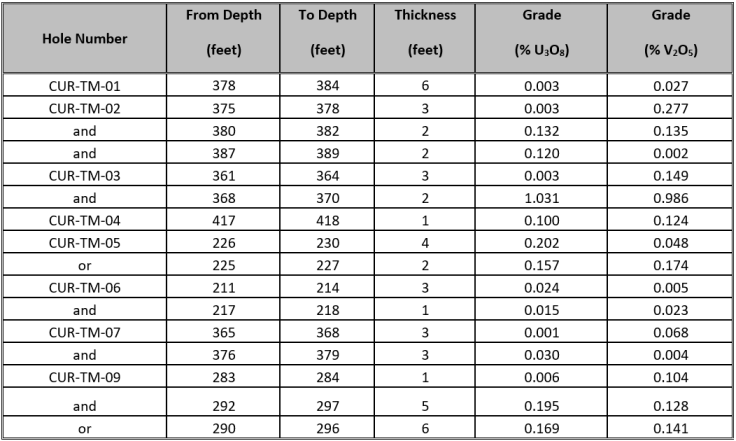

Table 2: Select assay results from the 8-hole confirmation drill program at the Tony M Mine include:

Notes:

Notes:

*All grades reported above from ICP chemical assays from American Assay Labs (independent of CUR)

*Only radiometric data used for resource estimation

Chairman and CEO Phil Williams stated “We are very pleased with the results of the confirmation drill program and mineral resource estimate for the Tony M Mine. We were attracted to the project not only because it was a past producing mine with all the infrastructure and permits in place for rapid and low-cost restart when uranium market conditions warrant, but also because of the robust nature of the deposit which is confirmed by this mineral resource estimate. The indicated mineral resource grade of 0.28% U3O8 ranks among the highest of all US uranium projects. Additionally, we are encouraged by the previously untested vanadium potential which was highlighted in our drilling. As the only company with guaranteed access to the Energy Fuels White Mesa Mill, which has a vanadium recovery circuit, if this potential bears out it could improve the overall economics of the project. These results confirm the Tony M Mine’s place in our portfolio as our number one US asset and we look forward to an aggressive program at the project next year, which we expect will advance us towards a production decision.”

Figure 1: Location Map: Tony M Mine, Utah in proximity to the White Mesa Mill

Tony M Mine NI 43-101 Technical Report on Mineral Resources

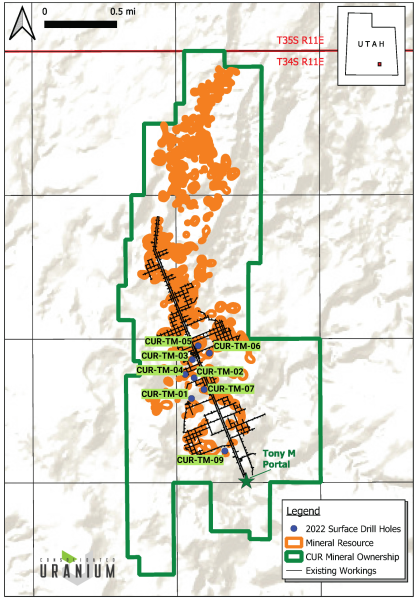

The completion of Mineral Resource estimate on the Tony M Mine, located in eastern Garfield County, Utah USA, is based upon historical exploration drilling data collected by previous holders of the project, and confirmed by the results of a combined rotary and core confirmation drilling program carried out in May and June of 2022 by Consolidated Uranium. The estimated Mineral Resources, which have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources (CIM 2014) are based upon data from 1,678 drill holes, totaling 947,610 feet of rotary and core drilling carried out by previous owners of Tony M and the Company. Uranium mineralization at the Tony M project is hosted in the lowermost 35 feet to 62 feet favorable sandstone portion of the Salt Wash Member, of the Jurassic age Morrison Formation, occurring as a series of generally flat lying bodies within one of three individual stratiform layers.

The Tony M Mineral Resource estimate was prepared using a conventional block modeling methodology. A digital geologic model of the lower Salt Wash was developed by SLR to constrain the Mineral Resource estimate. The Mineral Resource estimate used regularized block models, the inverse distance squared (ID2) grade interpolation methodology, and length-weighted, 1.0-foot, uncapped composites to estimate the uranium (eU3O8) in a three-search pass approach, using hard boundaries between subunits, ellipsoidal search ranges, and search ellipse orientation informed by geology. Average density values were assigned by lithological unit.

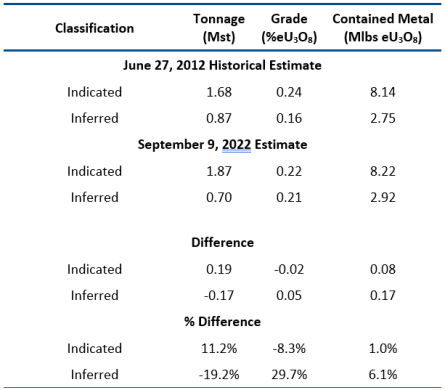

A comparison of the historical Mineral Resource estimate from June 27, 2012 (prepared for previous owner Energy Fuels Inc.) with the 2022 Mineral Resource estimate using a cut-off grade of 0.10% eU3O8 shows that Indicated Mineral Resources estimate tonnage increased by 0.19 million short tons and the grade decreased by 0.02% eU3O8, with a total increase of Indicated Mineral Resources of 0.08 million pounds of eU3O8. The Inferred Mineral Resource estimate tonnage decreased by 0.17 million short tons and the grade increased by 0.05% eU3O8 with the difference in Inferred Mineral Resources totaling 0.25 million pounds of eU3O8. The small differences between the estimates are primarily attributed to:

- A change in Mineral Resource estimation methodology from Grade-Thickness (GT) contouring to 3D block modelling.

- Block modelling tends to overestimate tons while under estimating grade due to smoothing during the grade estimation process, if not properly controlled.

- Modifications to the 2012 0.01% grade contour used to control horizontal extension of mineralization to allow for more accurate prediction of grade continuity during the block modelling process.

- Based on limited drilling intercepts, portions of the ML (middle lower) mineralized zone were downgraded from Inferred classification and removed from the Mineral Resource Estimate.

- Increase in past production depletion from 177,000 short tons to 258,000 short tons, based on SLR’s 2022 reconciliation of past production records.

Table 3: Comparison of Historical 2012 vs 2022 Mineral Resource Estimate

– Tony M Project (Using 0.10% cut-off)

Assay data from the CUR 2022 confirmation drilling program also highlighted the presence of vanadium mineralization. Results from the eight holes appear to indicate an inverse relationship between the vanadium to the uranium oxide grade, where the higher-grade vanadium is generally associated with the lower grade uranium mineralization. SLR notes the 2022 V2O5/U3O8 ratio ranges from an average of 1:1 to greater than 17:1 in places and results are comparable with historic reported ratios.

With the additional new 2022 vanadium assay data collected by CUR, SLR revisited the vanadium potential using a regression analysis curve at Tony M and found the 2022 V2O5/U3O8 ratio of approximately 3:1 is inline with historic reported ranges and much higher than the previously accepted ratio of 1.66:1 for the composite bulk samples collected over the period from October 1982 to January 1984. SLR opines the use of a vanadium regression curve and equation is an appropriate way to estimate vanadium resource potential in the future, however, the small sample size of the 2022 drilling vanadium values prevents construction of a reliable and accurate vanadium block model or Mineral Resource estimate until more data is collected to improve confidence and understanding of the vanadium distribution on the property.

SLR has recommended the following work to advance the Tony M Mine to the next stage:

- Carry out exploration drilling and vanadium sampling: drill approximately 75 holes to better define the distribution of vanadium mineralization, to increase U3O8 resources, and increase Inferred Mineral Resource to the Indicated classification.

- Access the underground workings at the mine for the purpose of mapping and sampling for vanadium.

- Prepare a PEA for the project, incorporating the results of the proposed uranium and vanadium surface drilling programs, and the results derived from the underground sampling program for vanadium.

Figure 2: Tony M Mine 2022 Drilling and Resource Outline

2022 Confirmation Drilling Program at the Tony M Mine Project

The surface rotary and core drilling program (previously announced in the Company’s February 17, 2022 press release) was designed to confirm the results of previous drilling carried out by Plateau Resources, who were the original discoverers and developers of the Tony M Mine.

The 2022 CUR drilling program was designed to confirm the stratigraphic position of uranium mineralization, the relative thicknesses of mineralized intervals, and the range of uranium grades that were encountered in the historical drill holes. The drill program was comprised of eight combined conventional rotary and core holes with vertical orientation, totaling 2,894 feet. Core samples from the CUR drilling were assayed for uranium and vanadium, although a very limited amount of historical data exists for vanadium. The program successfully verified the historic drill results as accurate and true for resource estimation.

CUR’s eight holes were drilled with a tri-cone rotary method (“conventional open-hole”) to the top of the lower rim of the Salt Wash sandstone unit, approximately 400 feet from surface. The rotary drill cuttings were collected at 5-foot intervals and the lithologies were recorded by CUR personnel. When the core point was reached (the top of the target horizon) a traditional 3-inch core barrel was placed on the drill string to core the entire Lower Rim of the Salt Wash sandstone. The zones that were cored in 20-foot-long intervals and were measured and marked by CUR personnel and logged for lithology, geotechnical properties, and mineralization. The core boxes were stored in a locked warehouse on the Tony M property.

Table 4: %U3O8 and %V2O5 Results of the 2022 CUR Confirmation Drilling:

*All grades reported above from ICP chemical assay from American Assay Labs

*Individual intervals chosen to maximize the U3O8 or V2O5 assay intercepts

*Only radiometric data used for resource estimation

Continuous geophysical logging of all of the CUR drill holes was carried out by Century Wireline Services of Tulsa, Oklahoma, and included natural gamma-ray, conductivity, and resistivity data from the boreholes. Core samples were bagged and shipped to American Assay Laboratories, in Sparks, Nevada for chemical determinations of U3O8 and V2O5 grades. American Assay is an independent mineral industry analytical laboratory that holds an ISO/IEC 17025 accreditation.

The Century Wireline geophysical probing equipment was calibrated at the US Department of Energy geophysical facility (the Grand Junction “test pits”) prior to the commencement of drilling and at the conclusion of the program, and a comparison of the results of the calibration runs showed no changes in gamma-ray responses.

The Company’s QA/QC (quality control/quality assurance) program for the core samples submitted to American Assay was consistent with industry standards and best practices and included the insertion of certified reference materials at three different grade levels (“standards”) obtained from OREAS North America, unmineralized standards (“blanks”), and duplicate samples from the core. Collectively, these QA/QC samples comprised approximately 18 percent of all of the samples (not including the internal control samples that the laboratory used) analyzed by American Assay.

SLR notes that the gamma logging estimates of equivalent uranium grade (%eU3O8) for the Tony M Project are slightly conservative and underestimate the average U3O8 grade by up to 3%, with some portions of the Tony M deposit underestimated by as much as 6%. The relative difference between chemical and probe assays is not considered material, no correction (disequilibrium ratio of 1:1) to the radiometric data is required, and the data is suitable for resource estimation.

Qualified Person

The scientific and technical information contained in this news release regarding the mineral resource estimate was reviewed and approved by Mark Mathisen, who is a “Qualified Person” (as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects).

All other scientific and technical information contained in this news release was reviewed and approved by Dean T. Wilton: PG, CPG, MAIG, who is a “Qualified Person” (as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects).

Technical Report

A Technical Report prepared in accordance with NI 43-101 for Tony M has been filed under the Company’s profile on SEDAR at www.sedar.com. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Private Placement of Virginia Energy Resources

The Company is also pleased to announce that on December 6, 2022 it completed its investment (the “Private Placement”) in Virginia Energy Resources Inc. (“Virginia Energy”) in connection with the proposed acquisition by the Company of all of the outstanding shares Virginia Energy (the “Virginia Shares”) pursuant to a statutory plan of arrangement, as previously announced on November 15, 2022. Pursuant to the Private Placement, the Company purchased, on a non-brokered private placement basis, 2,000,000 Virginia Shares at a price of $0.50 per Virginia Share, for aggregate consideration of $1,000,000. The Private Placement remains subject to the final approval of the TSX Venture Exchange.

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB: CURUF) was created in early 2020 to capitalize on an anticipated uranium market resurgence using the proven model of diversified project consolidation. To date, the Company has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina, and the United States each with significant past expenditures and attractive characteristics for development. Most recently, the Company completed a transformational strategic acquisition and alliance with Energy Fuels Inc., a leading U.S.-based uranium mining company, and acquired a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah and Colorado. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning CUR as a near-term uranium producer.

For More Information, Please Contact:

Philip Williams

Chairman & CEO

pwilliams@consolidateduranium.com

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future including, but not limited to, the Company’s ongoing business plan, exploration and work programs, mineral resource estimates, the interpretation of frilling results, future work recommendations and the expectations with respect to advancing the project. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to Consolidated Uranium set out in CUR’s annual information form in respect of the year ended December 31, 2020 filed with the Canadian securities regulators and available under CUR’s profile on SEDAR at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.