Consolidated Uranium Announces Proposed Spin-Out of Premier American Uranium Inc., Creating a New Pure-Play U.S. Uranium Company

Consolidated Uranium Subsidiary Premier American Uranium Enters Agreements to Acquire a Portfolio of Projects in Prolific U.S. Uranium Districts Timed for the Expected Revitalization of U.S. Domestic Uranium Production

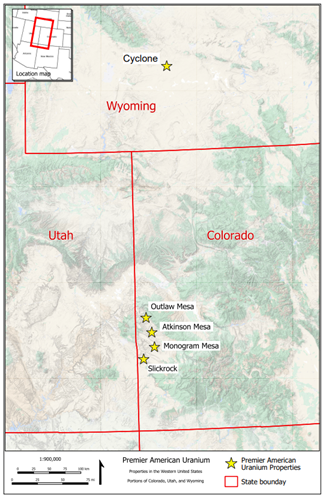

Toronto, ON May 24, 2023 – Consolidated Uranium Inc. (“CUR”, the “Company” or “Consolidated Uranium”) (TSXV: CUR) (OTCQB: CURUF) is pleased to announce the creation and planned spin-out (the “Spin-Out”) of Premier American Uranium Inc. (“PUR”), currently a majority-controlled subsidiary of CUR focused on the acquisition, exploration, and development of uranium projects in Wyoming and Colorado. (Figure 1).

On May 24, 2023, the Company entered into an arrangement agreement with PUR (the “Arrangement Agreement”), pursuant to which among other things the Company has agreed to transfer ownership of certain indirect wholly-owned subsidiaries which hold eight U.S. Department of Energy (“DOE”) leases and certain patented claims located in Colorado (the “CUR Assets”) to PUR in exchange for 7,753,752 Class A common shares of PUR (“PUR Shares”), a portion of which will be distributed to the Company’s shareholders on a pro rata basis (the “Arrangement”). PUR intends to apply to list the PUR Shares (the “TSXV Listing”) on the TSX Venture Exchange (the “TSXV”). The TSXV Listing will be subject to PUR fulfilling all of the requirements of the TSXV.

In addition, CUR and PUR have entered into a purchase agreement (the “Premier Agreement”) with, among others, Premier Uranium Inc. (“Premier”), a privately held U.S. uranium focused project acquisition vehicle which owns a 100% interest in the Cyclone project in the Great Divide Basin of Wyoming (the “Cyclone Project”) and various mining claims in the Uravan Mineral Belt of Colorado (collectively, the “Premier Assets”), pursuant to which PUR has agreed to acquire all of the outstanding shares of Premier.

Separately, PUR has also staked 368 unpatented mining claims, covering approximately 6,940 acres in key areas of the Uravan Mineral Belt.

To view a summary of today’s news delivered by Philip Williams, Chairman and CEO of CUR, and Tim Rotolo, Chief Executive Officer of Premier and planned Chief Executive Officer of PUR, click here.

Transaction Highlights:

- Stable, Long-term Shareholder Base Ahead of Public Market Listing – Backed by Sachem Cove Partners, CUR and with additional institutional investor support, PUR is working toward a public listing on the TSXV.

- Extensive Land Holdings in Two Prominent Uranium-Producing Regions in the U.S. – PUR plans to explore and develop its large land position in the Great Divide Base of Wyoming and the Uravan Mineral Belt of Colorado.

- Rich History of Past Production and Historic Uranium Mineral Resources with Strong Discovery Potential –

- The Cyclone Project, in Wyoming is an In Situ Recovery (“ISR”) project comprised of ~25,500 acres with past work supporting an exploration target with a range of 6.5 million short tons averaging 0.06% U3O8 (7.9 million lbs. U3O8) to 10.5 million short tons averaging 0.06% U3O8 (12.6 million lbs. U3O8).* See below for additional details.

- The Colorado projects include multiple past producing mines with historic uranium mineral resources and exploration potential.

- Well-Timed Opportunity with Strong Market Fundamentals and Need for U.S. Domestic Supply – Uranium fundamentals are the strongest in a decade with a large supply deficit as forecasted by industry and financial analysts. Security of supply following the Russian invasion of Ukraine is driving long-term contracting, a key feature leading up to the previous uranium price rally in 2005 to 2007. PUR presents an attractive opportunity to participate in the anticipated resurgence and advancement of the U.S. uranium industry.

- Unparalleled Experience in the U.S. Uranium Sector across the Team, Led by Disciplined Capital Allocators – PUR will be led by Tim Rotolo, co-founder of Sachem Cove Partners and Founder of Lloyd Harbor Capital Management, LLC, an SEC Registered Investment Advisor. Together, the PUR board of directors, management and technical team will have deep technical, operational, and permitting expertise in the U.S. with a track record of financing and advancing uranium companies and significant institutional investment experience in the uranium sector.

- Initiating Work Programs to Advance Portfolio in 2023 –

- Cyclone Project Exploration – Airborne radiometric survey completed in Q4 2022 in preparation for exploration and permitting activities planned for the remainder of 2023 and subsequent drilling expected in 2024.

- Uravan Mineral Belt Exploration –

- Monogram Mesa – Full data review for “on trend” exploration targets with subsequent drilling.

- Atkinson Mesa – Historical data review in preparation for planned drilling program to delineate the extent of mineralization in the central and northern parts of the properties.

- Additionally, PUR intends to look to further increase its land position both in Wyoming and the Uravan Mineral Belt of Colorado.

Philip Williams, Chairman and Chief Executive Officer of CUR, commented “We are very excited to announce the spin-off of PUR, in partnership with Sachem Cove. At CUR, our focus in the U.S. has been squarely on readying our past-producing Tony M, Daneros and Rim mines in Utah for production once market conditions warrant. This inherently meant our Colorado DOE leases, with a history of production and strong exploration potential, have received little attention. At the same time, in Premier, Tim and Sachem Cove have assembled a portfolio of projects in Colorado, which complement ours, as well as a compelling land package in the Great Divide Basin in Wyoming with large-scale ISR potential. CUR’s strategy has been to realize value in our portfolio, either directly by advancing projects to production, or through spinouts/divestures where a compelling strategic rationale could be identified, similar to our Labrador Uranium transaction last year. In PUR, we are convinced that this is a case where one plus one could equal much more than two and we believe CUR shareholders will be the ultimate beneficiaries when we complete the planned TSXV listing and direct distribution of PUR Shares in the coming months.”

Tim Rotolo, Chief Executive Officer of Premier and planned Chief Executive Officer of PUR commented, “The U.S. was once the global leader in uranium production at over 40 million pounds per year, enough uranium to supply nearly its entire nuclear fleet - the largest in the world and provider of 20% of U.S. electricity. Today, the U.S. produces almost none of its own domestically consumed uranium as U.S. utilities have turned to buying nearly half of their uranium needs from former Soviet states Russia, Kazakhstan, and Uzbekistan. We believe we are on the precipice of a resurgence in domestic production. For the first time in decades, a large supply deficit, which may push uranium prices higher, has converged with a global nuclear renaissance and newfound bi-partisan political support to safeguard our domestic nuclear fleet from geopolitical risk of a former Soviet-bloc dominated nuclear fuel cycle. In respect of this, we started Premier to capitalize on the U.S. uranium resurgence, accumulating projects and waiting for the right time to bring them to market. That time is now, and our partnership with CUR whose projects are complementary, sets up an exciting and well-timed launch for PUR.”

The Arrangement Agreement

Pursuant to the Arrangement Agreement, among other things, CUR has agreed to transfer certain indirect wholly-owned subsidiaries which hold the CUR Assets to PUR in exchange for 7,753,752 PUR Shares. Under the terms of the Arrangement, CUR intends to distribute 50% of the PUR Shares it receives to its shareholders on a pro-rata basis based on the number of CUR Shares held at the effective date of the Arrangement. There will be no change in CUR shareholders’ proportionate ownership in CUR as a result of the Arrangement. In addition, holders of options and warrants of CUR as of the effective date of the Arrangement will have such securities adjusted in accordance with their terms as a result of the Arrangement.

The Arrangement will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario). The Arrangement will be subject to regulatory approval, including the approval of the TSXV for the Arrangement and the TSXV Listing, court approval, as well as approval by not less than two-thirds of the votes cast at the annual general and special meeting (the “Meeting”) of the CUR shareholders, anticipated to be held in the third quarter of 2023. Full details of the Arrangement will be included in the management information circular to be sent to CUR shareholders in connection with the Meeting.

It is anticipated that the Arrangement and the TSXV Listing will be completed in the third quarter of 2023.

The Premier Agreement

On May 24, 2023, the Company and Premier entered into the Premier Agreement with PUR, among others, pursuant to which PUR has agreed to acquire all the outstanding shares of Premier in exchange for 12,000 Class B common shares of PUR (“Compressed Shares”). Each Compressed Share carries the right to 1,000 votes per share and is convertible into 1,000 PUR Shares, with each PUR Share carrying the right to one vote per share. Completion of the Premier Transaction is subject to certain closing conditions including, among other things, completion of the Arrangement and the conditional approval of the TSXV for the TSXV Listing.

About PUR

Proposed Management and Board of Directors

- Tim Rotolo, Chief Executive Officer

- 15+ years as an investment professional with background in fund management.

- Co-founder of Sachem Cove Partners and Founder of Lloyd Harbor Capital Management, LLC, an SEC Registered Investment Advisor.

- Founder of North Shore Indices, Inc., which launched URNM, a uranium mining ETF in 2019 and raised over $1 Billion before selling to NYSE listed, Sprott Asset Management.

- Greg Duras, Chief Financial Officer

- 25+ years in the resource sector in corporate development, financial management and cost control.

- Marty Tunney, Chairman

- Mining engineer with significant technical and capital markets experience.

- Current President and Chief Operating Officer of CUR.

- Michael Harrison, Director

- 25+ years of executive, financial and technical experience in the mining industry.

- Current Managing Partner at Sprott Inc.

- Daniel Nauth, Director

- Lawyer with a specialty in U.S.-Canada cross-border capital markets, M&A and corporate and securities transactions and regulatory compliance

Technical Advisors

- Ted Wilton

- 50+ years as a Senior Geologist in the mining industry, including 25+ in the uranium sector.

- Involved in discovering 8 deposits containing more than 10 million ounces gold in the U.S. and Australia.

- Mike Neumann

- 40+ years in environmental and regulatory affairs, specialized in uranium mine permitting in the U.S. and Kazakhstan.

- Gained regulatory approval for expansion of Daneros, compliance for Tony M, and Rim Mines in Utah.

- Tyler Johnson

- 14+ years formerly with Denison and Energy Fuels Inc.

- Geologist specializing in exploration, mine development, and resource estimation on uranium and vanadium projects.

The Projects

Figure 1: PUR Project Portfolio located in the States of Wyoming and Colorado

Wyoming – Great Divide Basin

Wyoming is one of the leading jurisdictions for U.S. uranium production and produced approximately 230 million lbs of U3O8 since the first discovery in the 1950s.1 The State ranked 11th of 84 jurisdictions in the Public Policy Perception Index of the Fraser Institute Annual Survey of Mining Companies 2021.2

The Great Divide Basin is also one of the least exploited of the Wyoming Basins known to contain significant deposits of uranium, including the Crooks Gap mining district, Sweetwater deposit, Lost Creek ISR mine. Nearby property owners include Uranium Energy Corp. and UR-Energy Inc.1

Cyclone Project

The Cyclone Project is located approximately 45 miles northwest of Rawlins, Wyoming and 15 miles from the Sweetwater Uranium Mill. The project covers 25,500 acres comprising: 1,061 claims totaling 21,220 acres and 7 state leases covering 4,280 acres.

The uranium deposits in the basin are hosted in flat-lying sandstones of the Battle Spring Formation, with a widespread alteration of host sandstones and numerous roll-front uranium deposits associated with altered rocks. Exploration potential remains high on the project with drilling required to follow up on historic work and delineate mineralized zones.

Previous exploration on the project includes ~80 holes drilled during 2007-2008, with mineralization showing typical grades and thicknesses to uranium deposits found elsewhere in the Great Divide Basin. Intersections from exploration on the Rim Target include hole UT-8 which intersected 8.0 ft. averaging 0.092% eU308 (0.02% cut-off) or 5.5 ft. @ 0.121% eU308 at 200 feet from the surface and hole UT-44 which intersected 7.5 ft. averaging 0.081% eU3O8 (0.02% cut-off grade) or 5.5 ft. averaging 0.104% eU308 at a 0.05% cut-off grade.

Sufficient historical exploration data is available for the North and East claim blocks to define an exploration target, which shows a range of 6.5 million short tons averaging 0.06% U3O8 (7.9 million lbs. U3O8) to 10.5 million short tons averaging 0.06% U3O8 (12.6 million lbs. U3O8). The potential quantity and grade of this exploration target is conceptual in nature and based on the geologic interpretation that mineralization is roll-front sandstone – type mineralization, and that mineralization is present as indicated by airborne radiometric anomalies, indications of the presence of oxidation reduction interfaces with associated uranium mineralization as depicted in available historic drill data. There has been insufficient exploration to define a mineral resource and it is uncertain if a mineral resource will be delineated. For the definition of the exploration target, the following criteria based on direct knowledge and experience in the area and similar sandstone hosted uranium deposits in the Great Divide Basin and other areas of Wyoming was used: (i) a minimum cut-off grade of 0.02% U3O8 and a grade thickness product (GT) of 0.10, (ii) a radiometric disequilibrium factor of 1, and (iii) a bulk density of 16 cubic feet per ton.

A detailed review of the historical drill data is planned with permitting underway in preparation for drilling in 2024.

Colorado – Uravan Mineral Belt

The Uravan Mineral Belt of Colorado has a rich history of uranium exploration and production and produced nearly 80 million lbs of U3O8 and more than 400 million lbs of V2O5 since 1945.3 Colorado ranked 5th of 62 jurisdictions in the Investment Attractiveness Index of the Fraser Institute Annual Survey of Mining Companies 2022.4 PUR’s projects in Colorado are in the heart of the Uravan Mineral Belt, in proximity to significant infrastructure. Mineralization is hosted in the Salt Wash Member of the Morrison Formation.

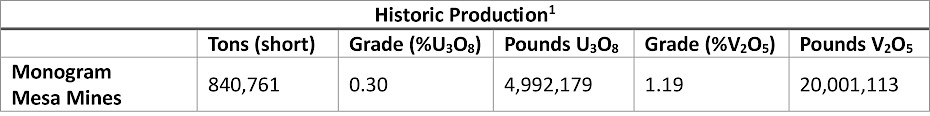

Monogram Mesa

The Monogram Mesa project covers approximately 7,431 acres and consists of 361 mining claims.

The property includes multiple historic mines on the northeast and the West (Bull Canyon) sides of Monogram Mesa. The historic mines are generally stable and dry, with numerous mineralized zones exposed. The property is strategically located within several miles of a paved highway with mine roads and power lines crossing the property. Historical drilling data indicates presence of numerous exploration targets.  1. As disclosed in Nelson-Moore, James L, Donna Bishop Collins, and A. L. Hornbaker, 1978; Radioactive Mineral Occurrences of Colorado, Colorado Geological Survey Bulletin 40, 1,054 pages, 18 figures, 3 tables, 12 plates.

1. As disclosed in Nelson-Moore, James L, Donna Bishop Collins, and A. L. Hornbaker, 1978; Radioactive Mineral Occurrences of Colorado, Colorado Geological Survey Bulletin 40, 1,054 pages, 18 figures, 3 tables, 12 plates.

An exploration drilling program to confirm and potentially expand currently known mineralization is planned with the potential to acquire surrounding properties, further consolidating the area.

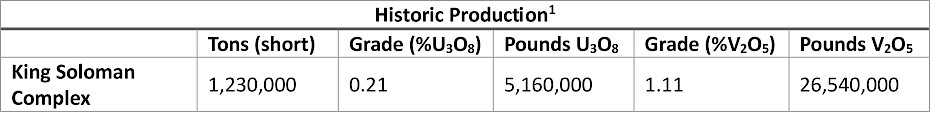

Atkinson Mesa Project

The Atkinson Mesa project covers 5,863 acres, including 128 unpatented lode mining claims, 4 DOE leases. The project also includes approximately 2,702 acres, and 18 patented (fee simple) mining claims spanning 360 acres. Several past producing mines are present on the property, including the King Solomon mine, a large-scale underground mine that was one of the most significant uranium producers in the entire Uravan Mineral Belt.5 The property is situated within one of the most substantial uranium-vanadium production areas within the entire Uravan Mineral Belt.5  1. Goodnight, Craig S., William L. Chenoweth, Richard D. Davyaault, and Edward T. Cotter, 2005; Geologic Road Log for Uravan Mineral Belt Field Trip, West-Central Colorado; Rocky Mountain Section of Geological Society of America, 2005 Annual Meeting.

1. Goodnight, Craig S., William L. Chenoweth, Richard D. Davyaault, and Edward T. Cotter, 2005; Geologic Road Log for Uravan Mineral Belt Field Trip, West-Central Colorado; Rocky Mountain Section of Geological Society of America, 2005 Annual Meeting.

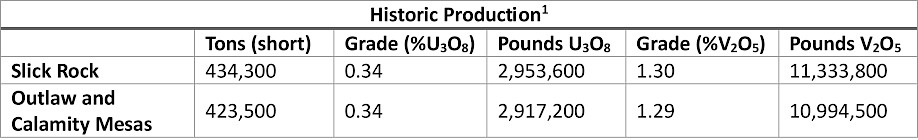

Outlaw Mesa & Slick Rock Projects

The Outlaw Mesa and Slick Rock projects are located at the northern and southern ends of the Uravan Mineral Belt, respectively. Outlaw Mesa covers 5,759 acres with 2 DOE leases and Slick Rock covers 1,226 acres with 2 DOE leases.

Both projects include historic production from multiple mines, including the well-known Spud Patch mines in the Slick Rock area and the Calamity Mesa mines in the Outlaw mesa-Calamity Mesa area. All leases contain uranium and vanadium mineralization. In January 2020, a new 10-year lease was signed with the DOE, providing long-term potential for the project.

1. As disclosed in the above and by Nelson-Moore, James L, Donna Bishop Collins and A. L. Hornbaker, 1978; Radioactive Mineral Occurrences of Colorado, Colorado Geological Survey Bulletin 40, 1,054 pages, 18 figures, 3 tables, 12 plates.

1. As disclosed in the above and by Nelson-Moore, James L, Donna Bishop Collins and A. L. Hornbaker, 1978; Radioactive Mineral Occurrences of Colorado, Colorado Geological Survey Bulletin 40, 1,054 pages, 18 figures, 3 tables, 12 plates.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Dean T. Wilton: PG, CPG, MAIG, a consultant of CUR who is a “Qualified Person” (as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects).

The data disclosed in this news release is related to historical drilling results. CUR has not undertaken any independent investigation of the sampling, nor has it independently analyzed the results of the historical exploration work in order to verify the results. CUR considers these historical drill results relevant as the Company is using this data as a guide to plan exploration programs. The Company's current and future exploration work includes verification of the historical data through drilling.

About Premier American Uranium Inc.

Premier American Uranium Inc., a subsidiary of Consolidated Uranium Inc. (“TSXV:CUR”), is focused on the consolidation, exploration, and development of uranium projects in the United States. One of PUR's key strengths lies in the agreements it has to acquire extensive land holdings in two prominent uranium-producing regions in the United States: the Great Divide Basin of Wyoming and the Uravan Mineral Belt of Colorado. With a rich history of past production and historic uranium mineral resources, PUR is initiating work programs to advance its portfolio in 2023.

Backed by Sachem Cove Partners, CUR, additional institutional investors, and an unparalleled team with U.S. uranium experience, PUR's entry into the market comes at a well-timed opportunity, as uranium fundamentals are currently the strongest they have been in a decade.

PUR intends to apply to list its shares on the TSXV, cementing its position as a leading U.S. uranium player. Listing will be subject to PUR fulfilling all of the requirements of the TSXV.

For more information, please visit www.premierur.com.

About Consolidated Uranium Inc.

Consolidated Uranium Inc. (TSXV: CUR) (OTCQX: CURUF) was created in early 2020 to capitalize on an anticipated uranium market resurgence using the proven model of diversified project consolidation. To date, Consolidated Uranium has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina, and the United States each with significant past expenditures and attractive characteristics for development.

Consolidated Uranium completed a transformational strategic acquisition and alliance with Energy Fuels Inc., a leading U.S.-based uranium mining company, and acquired a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah and Colorado. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning Consolidated Uranium as a near-term uranium producer.

For More Information, Please Contact:

Philip Williams

Chairman and CEO

pwilliams@consolidateduranium.com

Toll-Free: 1-833-572-2333

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information.

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to the timing and outcome of the Arrangement, the Premier acquisition and the Listing, including required shareholder, regulatory, court and stock exchange approvals; the anticipated timing of the Meeting; the anticipated benefits of the Arrangement; the satisfaction or waiver of the closing conditions set out in the Arrangement Agreement and the Premier Agreement; the exploration activities anticipated for the remainder of 2023 and 2024; the anticipated management team and board of directors of PUR; the final approval of the Arrangement and Listing by the TSXV; anticipated strategic and growth opportunities; expectations regarding the U.S. uranium industry; any expectations with respect to defining mineral resources or mineral reserves on any of the projects and any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development or production and other activities, events or developments that the Company expects or anticipates will or may occur in the future. Generally, but not always, forward- looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, completion of the Arrangement, the Listing and the Premier acquisition, including the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court and shareholder approvals; the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the Arrangement, the Listing and the Premier acquisition; that the anticipated benefits of the Arrangement will be realized; that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: the failure to obtain shareholder, regulatory, court or stock exchange approvals in connection with the Arrangement, the Listing and the Premier acquisition; failure to realize the anticipated benefits of the Arrangement or implement the business plan for PUR; the diversion of management time on transaction-related issues; expectations regarding negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approval and the risk factors with respect to Consolidated Uranium set out in Consolidated Uranium’s annual information form in respect of the year ended December 31, 2022 which has been filed with the Canadian securities regulators and is available under Consolidated Uranium’s profile on SEDAR at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

*The potential quantity and grade of this exploration target is conceptual in nature and based on the geologic interpretation that mineralization is Sandstone Type mineralization, aerial radiometric anomalies, and indications of the presence of oxidation reduction interfaces with mineralization from available drill data. There has been insufficient exploration to define a mineral resource and it is uncertain if a mineral resource will be delineated.

1 Source: Wyoming State Geological Survey; Critical Minerals in Wyoming; https;//www.wsgs.wyo.gov/minerals/critical-minerals.aspx

2 Source:www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2021.pdf?v=031002

3 Source: Chenoweth, William L., 1981, "The Uranium-Vanadium Deposits of the Uravan Mineral Belt and Adjacent Areas, Colorado and Utah. In New Mexico Geological Society Guidebook 32, Western Slope, Colorado" and Goodnight, Craig S., William L. Chenoweth, Richard D. Davyault and Edward T. Cotter, 2005: "Geologic Road Log for Uravan Mineral Belt Field Trip, West-Central, Colorado" Rocky Mountain Section of the Geologic Society of America.

4 Source: www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2022.pdf?v=031002

5 Source: Goodnight, Craig S., William L. Chenoweth, Rochard D. Davyault and Edward T. Cotter, 2005; Geologic Road Log for Uravan Mineral Belt Field Trip, West-Central Colorado; Rocky Mountain Section of the Geological Society of America.