Consolidated Uranium Provides Update to Shareholders

Toronto, ON, January 3, 2023 – Consolidated Uranium Inc. (the "Company", “CUR” or “Consolidated Uranium”) (TSXV: CUR) (OTCQB: CURUF) is pleased to share an open letter from Chairman and Chief Executive Officer, Philip Williams, to shareholders of the Company.

Dear Fellow Shareholders:

As we begin 2023, I wanted to take a moment to reflect on our Company’s achievements over the past year and set out our objectives for the upcoming year and beyond.

Industry Dynamics Still Point to a Bright Future

Given the relative weakness in uranium prices and the poor performance of uranium equities over the second half of 2022, it may be hard to look at 2023 with a great deal of optimism. However, we at CUR believe the future continues to look bright for the sector and that 2023 may turn out to be a pivotal year for the nuclear industry and by extension the uranium sector.

Uranium spot prices now sit at US$47.60 per pound versus US$43.25 per pound a year ago, representing an increase of 10%, however this only tells half of the story. In April spot prices peaked at US$63.75 dropping back to US$50.00 in May and staying relatively range bond over the balance of 2022. This performance mirrored global equity markets, showing the commodity is not immune to overall market conditions. The long-term price indicator of Uranium now sits at US$53.00 per pound up from US$45.00 per pound or an increase of 18% from one year ago. Although both of these prices are important, two other recent values point toward higher prices going forward:

- The first is US$56.20 per pound, which is the current level of TradeTech’s production cost indicator, defined as the weighted average life-of-mine cost needed to support additional uranium production required to sustain the global nuclear fuel industry. Given inflationary pressures on many of the key inputs in the mining industry, while we could argue that the cost of uranium production is actually higher, this number indicates that uranium prices, both spot and long term, need to rise dramatically in order to support required future production.

- The second is US$70.50 per pound, which is the price the US Government recently agreed to pay when purchasing 100,000 pounds of uranium as part of creating its Uranium Reserve Program. This price was the highest reported as part of the program which included five different sellers, and we believe it is a clear signal that the price required to support much needed new production in the US is likely above of US$70.00 per pound.

Turning to the nuclear industry, this is where things get very interesting. Over the past year it seemed that a week didn’t go by without a significant announcement relating to new nuclear build plans or reactor life extensions, international acceptance for nuclear power and small modular reactor news, with most of these announcements underpinning a strong demand for nuclear going forward. This anecdotal positive demand for nuclear power was quantified by the International Atomic Energy Agency (the “IAEA”) in its projections for Nuclear Power Growth published in September 2022 where, for the second year in a row, the IAEA revised upwards its annual projections. In its high case scenario, the IAEA now sees world nuclear generating capacity more than doubling by 2050 to 873 gigawatts net electrical (GWe), representing an increase of 10% compared with last year’s report. This is the scenario we are preparing for at Consolidated Uranium.

Dual Track Business Model Takes Shape

In our 2021 year end letter to shareholders, we outlined the dual track business plan for the year consisting of both continued, opportunistic project acquisitions as well as project level work to advance the existing portfolio. I’m pleased to report that both objectives were achieved in 2022:

- On the acquisition front, we added several key projects in Australia where we now have 6 projects in Queensland located in the key uranium areas in the state. We also announced our first foray into South Australia which we view as a premier uranium mining jurisdiction with a mine currently operating and several exciting exploration and development projects. Most significantly, we announced the acquisition of Virginia Energy Resources Inc., owner of the Coles Hill project in Virginia which ranks as the largest undeveloped uranium project in the United States. Following completion of the acquisition of Virginia Energy, which is expected in late January, CUR’s portfolio will boast exposure to one of the largest uranium endowments of any of its peers.

- On the project advancement front, our main focus for the year was the drill programs at our three past-producing mines located in Utah, United States. This work, while still underway, led to the completion of a NI 43-101 mineral resource estimate for the Tony M project and highlighted several recommended work programs for the project, which we intend to pursue in 2023. In Argentina, our team has completed a large-scale surface program aimed at identifying mineralization beyond the area of the historic mineral resource estimate. We expect that the results from this work program will be released in the first quarter of 2023.

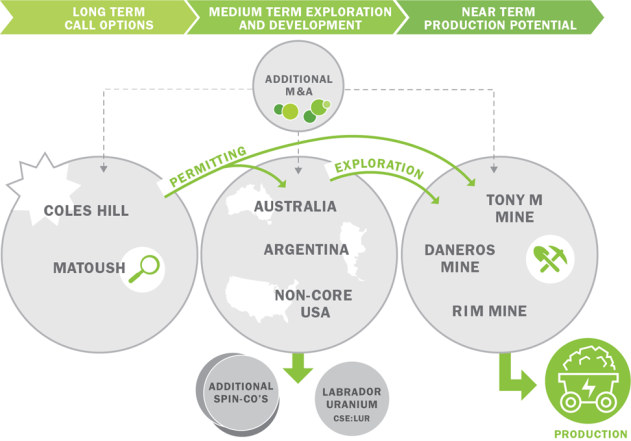

Looking forward, the roadmap for the Company is to become a globally significant, multi-asset, diversified miner and developer of uranium projects. We created the graphic below to illustrate our strategy (Figure 1). It shows the three categories our current projects fit in: Near Term Production Potential, Medium Term Exploration and Development and Long Term Call Options. Our goal is to continue adding to the Near Term Production Potential category through either the advancement of our existing projects from the other two categories or through additional M&A activity. As we move toward this goal, we recognize that certain existing projects may be better suited for additional spin-out transactions, as we did with Labrador Uranium Inc. (LUR:CSE) early in 2022.

Figure 1: CUR Strategy and Portfolio Roadmap

2023 Promises to be Another Pivotal Year for CUR

With another busy and successful year completed we turn our attention to 2023. Major themes we expect to see this year include continued M&A in the sector and continued focus from investors and end users on diversifying away from higher risk geopolitical countries. In addition, we believe that the increased view of nuclear, and therefore uranium, as a key source of low-carbon, base load power generation will land uranium on the radar of a larger audience of investors, including both generalists and clean energy transition funds. In closing, I can confidently reiterate the following highlights from last years letter to our shareholders, which continue to be representative of our strategy and investment case:

- CUR is in the right sector at the right time; uranium is currently in a bull trend and has the potential to deliver robust returns for equity investors;

- CUR has the right team, which together boasts decades of uranium, M&A, exploration and mine development expertise;

- CUR has the right portfolio, a diversified, fast growing portfolio of projects located in top tier mining and uranium jurisdictions with significant past expenditures and near-term production potential; and

- CUR has a proven track record. In less than three years, the Company has executed multiple M&A transactions, secured multiple financings and has increased market recognition as measured by market capitalization and trading liquidity.

I would like to thank all of you for your continued support and joining us on this journey.

Yours truly,

Philip Williams, Chairman and Chief Executive Officer

Grant of Compensation Securities

Pursuant to CUR’s long term incentive plan, the Company has granted certain officers, directors, employees and consultants options to purchase an aggregate of 1,125,000 common shares of the Company and an aggregate of 225,000 restricted share units. The options are exercisable at a price of $1.62 per common share for a period of five years and vest over three years as follows: one-third vesting immediately, one-third vesting after one year and one-third vesting after two years. The restricted share units, each of which entitles the holder to receive one common share of the Company, vest over three years as follows: one-third vesting after one year, one-third vesting after two years and one-third vesting after three years. The options and restricted share units are subject to approval of the TSX Venture Exchange.

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB: CURUF) was created in early 2020 to capitalize on an anticipated uranium market resurgence using the proven model of diversified project consolidation. To date, the Company has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina, and the United States each with significant past expenditures and attractive characteristics for development. Most recently, the Company completed a transformational strategic acquisition and alliance with Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR), a leading U.S.-based uranium mining company, and acquired a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah and Colorado. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning CUR as a near-term uranium producer.

For More Information, Please Contact

Philip Williams

Chairman and CEO

pwilliams@consolidateduranium.com

Toll-Free: 1-833-572-2333

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future including expectations regarding Uranium prices and the potential to deliver robust returns for equity investors, expectations regarding world nuclear capacity, expectations regarding potential value creation from project acquisitions and advancement, expectations regarding project-level activities and new M&A activity, the Company’s ongoing business plan and approval of the TSX Venture Exchange. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration and development activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to Consolidated Uranium set out in CUR’s annual information form in respect of the year ended December 31, 2021 filed with the Canadian securities regulators and available under CUR’s profile on SEDAR at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.