Consolidated Uranium to Acquire the Past Producing Huemul Uranium-Vanadium-Copper Project in Argentina

Toronto, ON, June 14, 2023 – Consolidated Uranium Inc. (“CUR”, the “Company”, “Consolidated Uranium”) (TSXV: CUR) (OTCQX: CURUF) is pleased to announce that it has entered into two purchase agreements to acquire 100% of the Huemul-Agua Botada Uranium-Vanadium-Copper Mine (“Huemul”) and surrounding prospective ground totalling ~27,350 hectares located in the Malargüe department of southern Mendoza province, Argentina (Figure 1) (collectively referred to as the "Huemul Project”). Huemul was Argentina´s first producing Uranium mine and operated between 1955 and 1975, recording approximately 500,000 pounds of historical U3O8 production before it closed in 1976.1

Highlights

- Adds Second Argentine Project in Mining Friendly Region – CUR has been actively working in Argentina since the acquisition of the Laguna Salada project in late 2021. Beyond the technical merits of Huemul, its location in the mining friendly Malargüe department of Mendoza province was an important consideration in making the acquisition.

- Leverages Existing In-Country Expertise – The CUR team in Argentina boasts decades of experience operating in the country exploring for and developing various commodities, including uranium. The team conducted numerous technical due diligence site visits and stands ready to move quickly to advance the project once required approvals and permissions are granted.

- Transaction Consolidates Large Land Package for the First Time – The Huemul area, including the historic mine area, was the subject of exploration by several different owners in the past. This will be the first time the entire package has been held in a single hand opening the potential for a more regional exploration approach.

- High Uranium, and Copper Grades Previously Recovered – The Huemul mine historically recorded approximately 500,000 pounds of U3O8, ~175,000 pounds of V2O5 and 5.2 million pounds of Cu production from approximately 130,000 tonnes of ore averaging 0.21% U3O8, 0.11% V2O5 and 2.00% Cu by flotation at a concentration plant.

- Robust Near Mine and Regional Exploration Potential – The down-plunge and along-strike extensions of mineralization at the Huemul mine and Aguas Botada zones are underexplored and merit additional exploration work. In addition, the target geological sequence is present and mineralized at surface over large areas across the project. Gently dipping conglomerate units hosting the mined ore at Huemul extend southwards from the historic mine workings and are traceable over at least 15 kilometers. Within this target stratigraphic package, strong Uranium-Vanadium-Copper geochemical anomalies, with broad corresponding Uranium and Thorium radiometric anomalies, have been defined by a previous exploration company. These anomalies have never been drilled.

- Multiple Critical Minerals Present – Uranium, copper and vanadium are considered critical minerals by many countries based on their importance for the transition towards more environmentally friendly “green” energy.

- Argentina Needs Uranium – With three reactors currently generating approximately 7% of the country’s electricity, a fourth under construction and a history of producing, converting and enriching its own uranium; CUR believes exploring for developing uranium mines in Argentina has strong merit and may ultimately garner support by all levels of government.

Philip Williams, Chairman and CEO of CUR commented, “Argentina is often overlooked in the CUR portfolio but is a country that presents significant opportunities. Few jurisdictions that have such a strong commitment to nuclear power also have the proven geological potential to provide domestically sourced uranium. In this regard it is very similar to the dynamics unfolding in the U.S. uranium industry however, the level of competition in Argentina is nearly non-existent, providing a tremendous opportunity to CUR. The Huemul Project, with its history of uranium mining and large, consolidated land package positions CUR to be one of the leading Uranium explorer-developers in Argentina´s Neuquén basin, which could rival the large historic Uranium producing basins located in the western U.S. and Kazakhstan. Huemul was Argentina´s first producing Uranium mine and we believe that its location in the emerging mining-friendly department of Malargüe, as well as its vanadium and copper potential represents an exciting opportunity for the Company.”

Figure 1: Map showing location of the Huemul Project in Argentina located in proximity to the Comisión Nacional de Energía Atómica’s Sierra Pintada Uranium Mine

Consolidation of the Huemul Project Claim Package

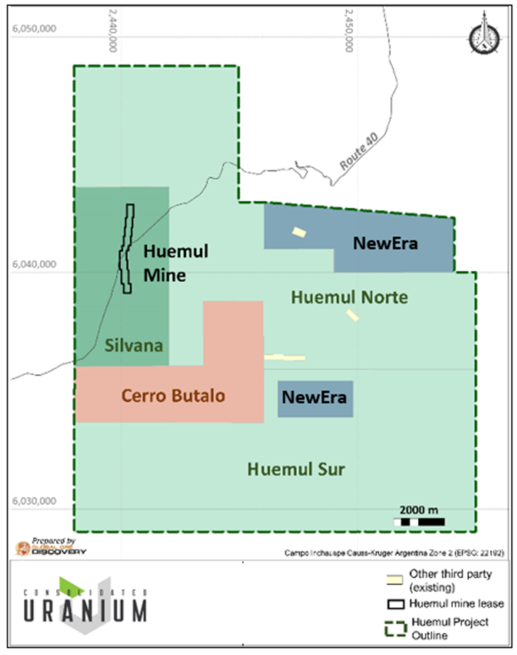

The consolidated Huemul Project claim package consists of three areas as shown in Figure 2:

- The Huemul Mine, the Silvana Claim and Huemul Norte and Sur Claim applications - As part of the Huemul Acquisition (as defined herein), the Company has agreed to acquire the Huemul mine lease, the Silvana claim the Huemul Norte and Huemul Sur claim applications totalling approximately ~22,432 hectares.

- The NewEra Claims - As part of the NewEra Acquisition (as defined herein), the Company has agreed to acquire two claim applications covering ~2,352 hectares (the “NewEra Claim Applications”) held by NewEra Metal Resources Ltd. (“NewEra”).

- The Cerro Butalo Claims - Cerro Butalo, covering ~2,566 hectares, was previously staked by Energy Minerals/Maple and was acquired by the Company in 2020 pursuant to an option agreement with Green Shift Commodities Ltd. (previously U3O8 Corp.) (see CUR press release December 14th, 2020).

Figure 2:Map showing the various claims and claim applications comprising the Huemul Project in Argentina

Terms of the Huemul Acquisition

Pursuant to an agreement between CUR´s wholly-owned subsidiary, 2847312 Ontario Inc. (“Ontario Inc.”), and the vendor of Huemul (the “Huemul Vendor”) dated June 13, 2023 (the “Huemul Agreement”), Ontario Inc. has agreed to acquire (the “Huemul Acquisition”) a 100% interest in ~22,432 hectares within the Huemul Project Area held by the Huemul Vendor (the “Huemul Claims”) for consideration comprised of:

- US$200,000 in cash;

- 500,000 common shares of CUR (“Common Shares”); and

- A 2% NSR royalty payable by the Company to the Huemul Vendor on certain portions of the Huemul Project (the “Huemul Royalty”). CUR will have the right to repurchase 1% of the Huemul Royalty by paying the amount of US$2,000,000.

Terms of the Purchase Agreement with NewEra

Pursuant to an agreement between Ontario Inc. dated June 13, 2023 (the “NewEra Agreement”), Ontario Inc. has a right to acquire (the “NewEra Acquisition” and together with the Huemul Acquisition, the “Acquisitions”) 100% interest of the NewEra Claim Applications for consideration comprised of:

- US$120,000 in cash;

- 119,372 Common Shares; and

- A 1% NSR royalty payable by the Company to NewEra on the claims covered by the NewEra Claim Applications.

The Common Shares issuable pursuant to the Huemul Agreement and the NewEra Agreement are subject to approval of the TSXV and will be subject to a hold period expiring four months and one day from the date of issuance. There are no finders’ fees payable in connection with the acquisitions and the Huemul Vendor and NewEra are arms-length parties with respect to the Company.

The Huemul Uranium-Vanadium-Copper Project

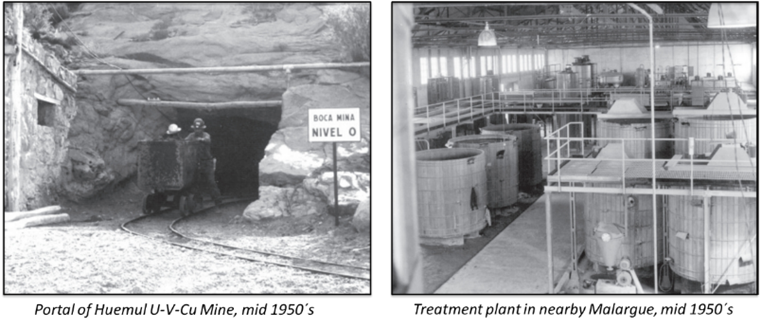

The Huemul Project is an early-stage exploration project located in the southern part of Mendoza Province, Argentina. Huemul consists of ~27,350 hectares of exploration claims centred around CNEA´s (Comisión Nacional de Energía Atómica) historic Huemul-Agua Botada mine, Argentina´s first producing Uranium mine (Figure 3). The Argentinian government discovered the Huemul-Agua Botada Zone in 1952 and exploited the deposit between 1955 and 1975. Historically, ore was treated in a concentration plant at the nearby town of Malargüe.

Figure 3: Photos showing the historic Huemul mine and nearby processing plant

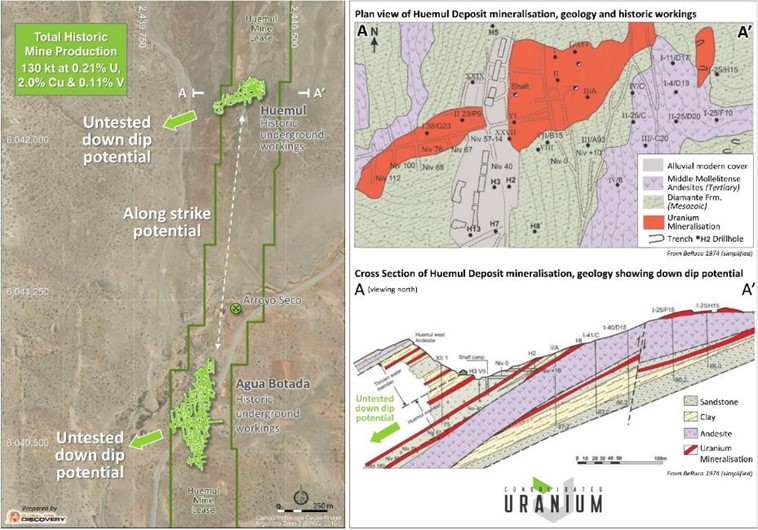

Uranium-Vanadium-Copper mineralization at Huemul comprises a number of stacked, metres-thick stratabound lenses hosted by an approximately 50-metre-thick packet of conglomerates and arenites, sandwiched by redbeds and intruded by andesite sills (Figure 4). These sedimentary rocks are part of the fill sequence of the Cretaceous Neuquén Basin. Host rocks to the mineralization are highly bituminous and mineralized zones are likely to have been failed petroleum-gas traps.

Approximately 130,000 tonnes were historically mined from the Huemul Mine averaging 0.21% U3O8, 2.0% Cu and 0.11% V2o5, while the production from the adjacent Agua Botada deposit averaged approximately 0.13% U3O8 and 0.10% Cu. The hypogene ore-related minerals at Huemul-Agua Botada include pitchblende, pyrite, marcasite, chalcopirite, bornite, sphalerite and galena, and in the overlying supergene zone uranophane, carnotite, torbenite, malachite, azurite, neoticite and roscolite.

Figure 3: Geological map and section through the historic Huemul mine operation

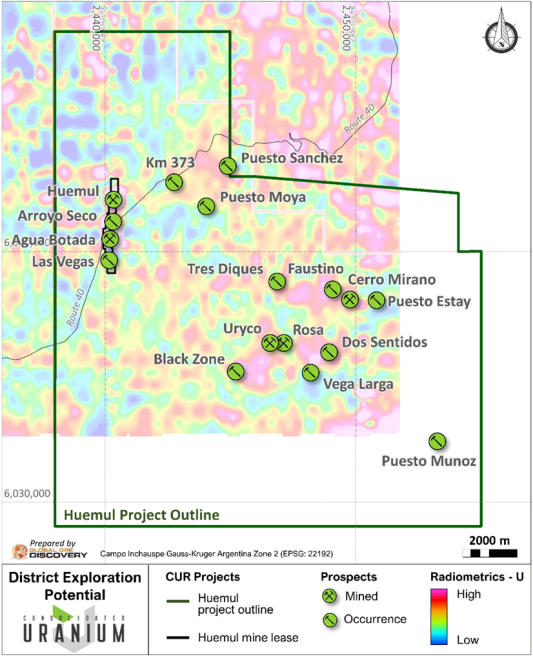

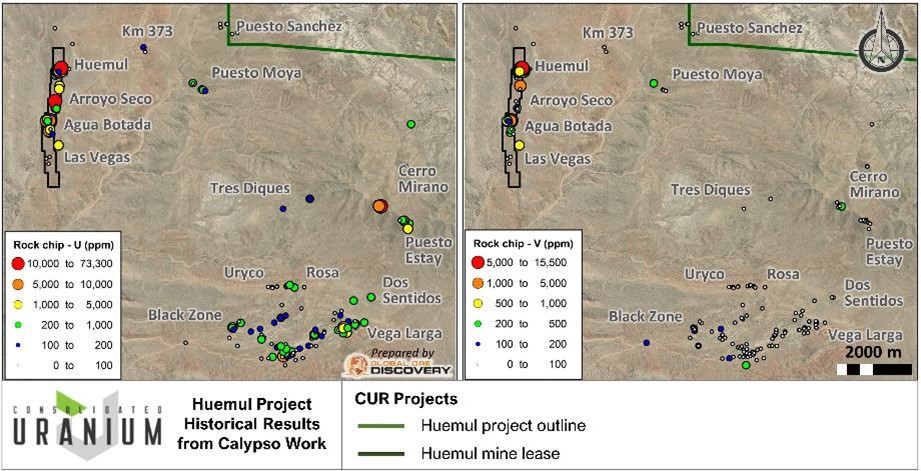

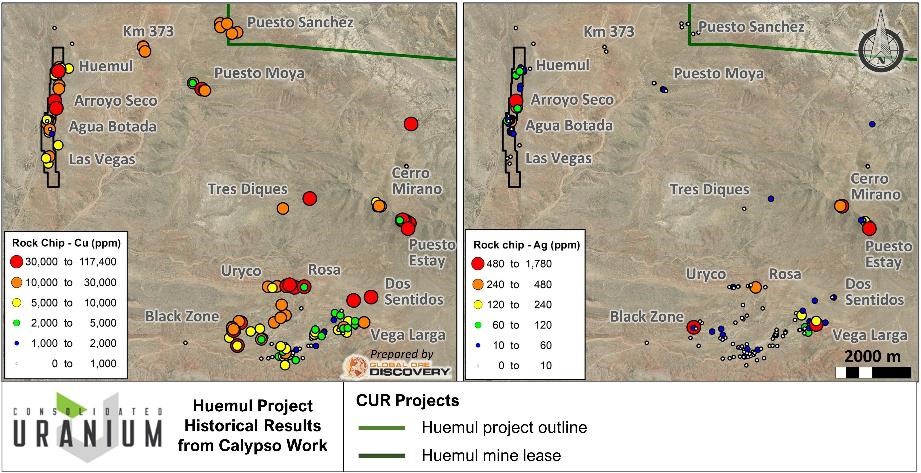

In 2005, Energy Minerals (local subsidiary of Calypso Uranium Corp.) conducted radiometric surveys, ground truthing and geochemical sampling over the Huemul district around the historic Huemul-Agua Botada mines; however, no drilling was ever conducted. Results of these historical studies are shown in Figures 5 to 7.

Figure 5: Map showing historic Uranium-channel radiometrics and prospects within the Huemul Project area

Figure 6: Map showing historic Uranium and Vanadium rock geochemistry anomalies, Huemul Project

Figure 7: Map showing historic Copper and Silver rock geochemistry anomalies, Huemul Project

Several kilometers to the east and southeast of the historic mines, Calypso Uranium defined a number of new prospects characterized by strong radiometric and geochemical anomalism plus favourable geology:

- Black Zone / Larga Vega

- Rosa / Uryco

- Cerro Mirano, Tres Diques

CUR´s more recent analysis suggests that these prospects all have both strong geochemical and radiometric similarities with Huemul, plus the size potential to warrant immediate follow up. These prospects only require interpretive geological mapping and radiometric ground traversing before proceeding to preliminary drill testing.

At the Black Zone-Vega Larga Prospect, a semi-coherent Uranium channel airborne radiometric anomaly approximately 4.0 x 1.0 kilometers in size was delimited, elongated in an ENE-WSW direction. The radiometric anomaly is centred on an erosional window of bleached conglomerates and sandstones sandwiched between redbed facies. Strongly radiogenic Uranium-Copper mineralisation is hosted by southwesterly-dipping Upper Cretaceous conglomerates of the Cretaceous Diamante Fm. A strong Uranium-Copper rock geochemistry anomaly of a similar size to the airborne radiometric anomaly reported Uranium values up to 8,738 ppm and Copper values in excess of 10,000 ppm (1%) in historic sampling. Follow up ground radiometry by Calypso Uranium allowed interpretation of laterally extensive, stratabound, potentially mineralized conglomerate units.

Preliminary surface observations by CUR in the Black Zone-Larga Vega prospect areas has confirmed the presence of Uranium and Copper sulfates/hydroxides in certain conglomerate beds and in steep fractures striking NE-SW and NW-SE. In addition, high scintillometer counts (1,700-50,000+ cps) have been confirmed in the field, particularly within silica-clay alteration zones within some conglomerate horizons. Verification of the historic geochemical assays reported has not yet been undertaken.

The historic results gathered by Calypso Uranium and CUR field verification indicate that the Huemul Project has potential to host extensive, and as yet undiscovered, zones of shallow conglomerate-hosted Uranium, Vanadium and Copper mineralization of a similar style to that historically exploited at the Huemul-Aguas Botadas mine.

Following the receipt of environmental and exploration permits, CUR´s 2023 exploration program at Huemul is expected to focus on more precisely defining the extent of radiometric and geochemical anomalies, through a program of detailed geological mapping, ground scintillometer traversing and systematic rock geochemical sampling. Potentially mineralized targets will later be tested through shallow diamond drilling.

Notes

1. Guillermo Rojas, 1999. Distrito Uranìfero Pampa Amarilla, Mendoza. En Recursos Minerales de la Republica Argentina. Pag.1135-1140

Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Peter Mullens (FAusIMM), Consolidated Uranium’s VP, Business Development, who is a “Qualified Person” (as defined in NI 43-101).

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQX: CURUF) was created in early 2020 to capitalize on an anticipated uranium market resurgence using the proven model of diversified project consolidation. To date, the Company has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina, and the United States each with significant past expenditures and attractive characteristics for development.

The Company is currently advancing its portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah and Colorado, with a toll milling arrangement in place with Energy Fuels Inc., a leading U.S.-based uranium mining company. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning CUR as a near-term uranium producer.

For More Information, Please Contact:

Philip Williams

Chairman and CEO

pwilliams@consolidateduranium.com

Toll-Free: 1-833-572-2333

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. “Forward-looking information” includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future including, but not limited to, completion of the Acquisitions, the approval of the TSXV and the Company’s ongoing business plan, sampling, exploration and work programs. Generally, but not always, forward-looking information and statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to Consolidated Uranium set out in CUR’s annual information form in respect of the year ended December 31, 2022 filed with the Canadian securities regulators and available under CUR’s profile on SEDAR at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.